Market Overview:

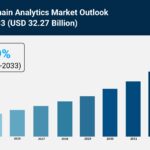

The supply chain analytics market is experiencing rapid growth, driven by proliferation of big data and connected devices, migration to cloud-based solutions, and increasing demand for operational efficiency and risk mitigation. According to IMARC Group’s latest research publication, “Supply Chain Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033”, the global supply chain analytics market size was valued at USD 9.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.27 Billion by 2033, exhibiting a CAGR of 16.69% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/supply-chain-analytics-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Supply Chain Analytics Market

- Proliferation of Big Data and Connected Devices

The sheer volume and velocity of data generated across modern supply chains is the fundamental driver for advanced analytics adoption. The expansion of Internet of Things (IoT) solutions—such as GPS trackers, RFID tags, and warehouse sensors—throughout logistics, manufacturing, and retail operations is creating massive datasets that far exceed human capacity for manual processing. Enterprises are increasingly acknowledging that they cannot achieve supply chain optimization or resilience without leveraging tools to process this influx of information. For instance, data from a major research institution indicates that the flow of data generated by both robotic and human activities is multiplying at a rate significantly faster than traditional business data, compelling organizations to adopt SCA solutions simply to maintain visibility and control.

- Migration to Cloud-Based Solutions

The availability and advantages of cloud-based Supply Chain Analytics platforms are democratizing the technology and significantly boosting market penetration, especially among Small and Medium Enterprises (SMEs). Cloud deployment offers superior scalability, flexibility, and cost-efficiency compared to legacy on-premise solutions, as it removes the need for substantial upfront investment in dedicated servers and infrastructure. Data from industry analysts highlight that the cloud segment has captured a dominant share of the deployment landscape, representing a large majority of the overall market. This model allows SMEs, supported by favorable government initiatives focused on digital upskilling, to access sophisticated analytics capabilities previously only affordable to large corporations, enabling them to streamline processes and compete more effectively.

- Increasing Demand for Operational Efficiency and Risk Mitigation

Growing complexity in global supply chains, coupled with sustained pressure to reduce costs and enhance customer service, is fueling the demand for SCA tools. Companies across sectors like manufacturing, retail, and transportation are recognizing the necessity of data-driven insights to manage sprawling global networks and mitigate the impact of unforeseen disruptions. For example, a report from a leading consulting firm suggests that over 90% of organizations plan to increase their investments in data and analytics to address these challenges. SCA solutions are instrumental in achieving waste minimization, optimizing inventory levels, and improving the accuracy of demand forecasts, which directly translates into millions in savings and a competitive edge in product delivery and responsiveness.

Key Trends in the Supply Chain Analytics Market

- Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The infusion of AI and Machine Learning algorithms is transforming supply chain analytics from merely descriptive (what happened) to predictive and prescriptive (what will happen and what should we do). This allows companies to move beyond reacting to problems toward proactive decision-making. Concrete examples include AI-powered demand forecasting engines that use diverse data sources, from point-of-sale information to weather patterns, to predict demand fluctuations with a high degree of accuracy. The adoption of these sophisticated tools enables manufacturers to achieve notable improvements in forecasting precision and significantly reduce inventory errors and delayed shipments, fundamentally reshaping inventory management and production planning.

- Real-Time, End-to-End Supply Chain Visibility

The need to track goods and information instantly across all tiers of the supply chain—from raw material suppliers to the final customer—is driving the trend toward real-time, end-to-end visibility. This involves the mass deployment of technologies such as IoT sensors, GPS tracking, and advanced control towers that consolidate data from disparate systems (like ERP, WMS, and TMS) into a single, unified view. The value is clear, as industry surveys indicate that a majority of supply chain executives consider this real-time insight to be absolutely critical for their operations, although only a small fraction have achieved full visibility so far. This capability allows businesses to immediately detect potential disruptions, such as transportation delays or quality issues, and implement prompt, agile responses.

- Focus on Sustainable and Ethical Sourcing Analytics

There is a rapidly accelerating trend to use supply chain analytics to measure, monitor, and improve Environmental, Social, and Governance (ESG) compliance and overall sustainability. Consumer demand for ethically sourced and environmentally responsible products is strong, with reports showing a significant percentage of consumers willing to pay more for goods from sustainable supply chains. Analytics tools are now being used to track metrics such as carbon emissions, water usage, and labor practices across the supplier network. For instance, companies are embedding ESG performance metrics into their supplier evaluation scorecards, using analytics to identify high-risk suppliers and calculate the carbon footprint of various transportation routes, enabling them to reduce emissions and strengthen their brand reputation.

Leading Companies Operating in the Supply Chain Analytics Industry:

- Axway

- Capgemini SE

- International Business Machines Corporation

- Infor Inc (Koch Industries Inc.)

- Kinaxis Inc.

- Manhattan Associates Inc.

- Microstrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC (Salesforce Inc.)

Supply Chain Analytics Market Report Segmentation:

By Component:

- Assays, Kits and Reagents

- Software and Services

Software leads the market due to its comprehensive capabilities in demand forecasting, supplier performance, procurement, inventory, and logistics optimization.

By Deployment Mode:

- On-premises

- Cloud-based

On-premises dominates as it offers greater data control, customization, security, and long-term cost benefits for sensitive or latency-critical operations.

By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises hold the largest share, leveraging analytics to optimize complex supply chains, improve efficiency, and meet ESG compliance.

By Industry Vertical:

- Automotive

- Food and Beverages

- Healthcare and Pharmaceuticals

- Manufacturing

- Retail and Consumer Goods

- Transportation and Logistics

- Others

Manufacturing leads the segment, utilizing analytics for demand prediction, inventory optimization, production scheduling, and logistics efficiency.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates, driven by advanced tech adoption, strong e-commerce growth, and a robust ecosystem of supply chain innovators.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302