Market Overview:

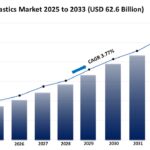

The automotive plastics market is experiencing rapid growth, driven by stringent emission and fuel efficiency regulations, surging production of electric and hybrid vehicles, and advancements in polymer technology and design. According to IMARC Group’s latest research publication, “Automotive Plastics Market Size, Share, Trends and Forecast by Vehicle Type, Material, Application, and Region, 2025-2033”, offers a comprehensive analysis of the industry, which comprises insights on the global automotive plastics market share. The global market size was valued at USD 44.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.63 Billion by 2033, exhibiting a CAGR of 3.77% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/automotive-plastics-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automotive Plastics Market

- Stringent Emission and Fuel Efficiency Regulations

Global governments and regional bodies have imposed increasingly strict regulations to curb vehicle emissions and boost fuel economy, significantly driving the demand for automotive plastics. These policies compel Original Equipment Manufacturers (OEMs) to reduce the weight of vehicles, as a 10% reduction in vehicle mass can improve fuel economy by 6% to 8%. This lightweighting strategy is most effectively achieved by replacing heavier traditional materials like steel and aluminum with high-performance polymers, which are lighter while maintaining safety and performance standards. Plastics like Polypropylene (PP) and Polyamide (PA) are widely used for exterior, interior, and under-the-hood components, directly supporting a country’s greenhouse gas emission reduction goals. The shift is evident in the fact that plastics can constitute up to 50% of the volume in lightweight vehicles, although contributing only about 10% of the total weight, making regulatory compliance a powerful market stimulant.

- Surging Production of Electric and Hybrid Vehicles

The rapid global transition toward Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) is a major growth catalyst. EVs require lightweight materials to compensate for the significant weight of their battery packs, which directly impacts driving range and energy efficiency. High-performance, specialty plastics and polymer composites are crucial for battery casings, structural components, and thermal management systems, where they must provide excellent insulation, flame retardancy, and durability. For instance, the demand for polymers in the EV market is expanding considerably due to their necessity in high-voltage busbar covers, e-motor cooling jackets, and structural battery components. This trend is quantified by the substantial increase in EV sales, which have grown exponentially over the past several years, creating a massive, dedicated new application area for advanced polymer solutions.

- Advancements in Polymer Technology and Design

Ongoing advancements in polymer science and manufacturing processes have expanded the application scope of plastics, replacing traditional materials in complex, structural components. New generations of advanced polymer composites, such as carbon fiber-reinforced plastics (CFRPs) and long-glass-fiber-reinforced Polypropylene, offer a superior strength-to-weight ratio, allowing for their integration into semi-structural parts like seat carriers and tailgates, which were previously metal-dominated. The technological progress in injection molding, including sequential gating and micro-cellular foaming, allows manufacturers to create intricate, multi-functional geometries at a speed and cost-effectiveness suitable for high-volume automotive production. These material and process innovations enable automakers to enhance vehicle design, performance, and safety while cutting down on overall manufacturing costs.

Key Trends in the Automotive Plastics Market

- Integration of Bio-based and Recycled Polymers

The automotive industry is embracing a circular economy model, leading to a significant trend in integrating bio-based and recycled polymers into vehicle production to meet sustainability commitments. Automakers are setting public goals for reducing their carbon footprint and increasing the use of sustainable content in their vehicles, driven by growing consumer environmental awareness. For example, recycled Polyethylene Terephthalate (rPET) is now being transformed into fibers for seating fabrics, carpeting, and headliners, particularly in vehicle interiors. Bio-based plastics, derived from renewable sources, are also gaining traction, with some major automakers introducing dashboards and interior parts made from new recyclable or bio-based polymer formulations, reinforcing the commitment to resource efficiency. This real-world application of sustainable materials is moving from concept to mass production.

- Customization and High-Aesthetic Interiors

A key emerging trend is the elevated focus on vehicle interior design, where plastics are crucial for delivering the premium feel and customization consumers demand. Plastics provide design flexibility that metals cannot match, allowing for complex geometries, soft-touch surfaces, and integrated features. Advanced polymer blends like PC/PMMA (Polycarbonate/Polymethyl methacrylate) are used for high-gloss, scratch-resistant trim and single-unit clusters that integrate digital displays and ambient lighting. This trend is driven by the fact that interior components accounted for a significant share of the total demand for automotive plastics in a recent base year. Customization features, such as haptic coatings and laser-etched graphics on instrument panels and door trims made from specialty plastics, are now extending from luxury to mass-market vehicle segments.

- Development of Smart and Multi-functional Composites

The market is shifting toward smart and multi-functional plastic composites that do more than just reduce weight. This involves developing materials that perform multiple roles, such as integrated sensor housing, energy harvesting, and electromagnetic shielding, which are vital for the evolution of autonomous and connected vehicles. One concrete example is the use of high-dielectric plastics in the structural housings and high-voltage components of electric vehicles, where the plastic provides both mechanical support and electrical insulation. Further innovation includes research into piezoelectric composites, which have the potential to harvest energy from car vibrations to power on-board electronics. This trend positions plastics as a central component in future vehicle architecture, supporting the increasing complexity of in-vehicle electronics and communication systems.

Leading Companies Operating in the Global Automotive Plastics Industry:

- Asahi Kasei Corporation

- BASF SE

- Borealis AG

- Covestro AG

- Dow Inc.

- Koninklijke DSM N.V.

- Lanxess AG

- Lear Corporation

- LyondellBasell Industries N.V.

- Saudi Basic Industries Corporation

- Solvay S.A

- Teijin Limited

Automotive Plastics Market Report Segmentation:

By Vehicle Type:

- Conventional and Traditional Vehicles

- Electric Vehicles

Conventional and traditional vehicles dominate the market with an 83.7% share, driven by their established presence, low cost, and the ongoing demand for automotive plastics that enhance durability and fuel efficiency.

By Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Polycarbonate (PC)

- Polyamide

- Others

Polypropylene (PP) leads the material segment with a 43.2% market share, valued for its lightweight, resilient properties, cost-effectiveness, and adaptability for various automotive applications while meeting sustainability goals.

By Application:

- Powertrain

- Electrical Components

- Interior Furnishings

- Exterior Furnishings

- Under the Hood

- Chassis

Interior furnishings hold the largest market share at 46.7%, as automotive plastics enhance vehicle comfort, aesthetics, and functionality, driven by user demand for innovative and eco-friendly designs.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific leads the automotive plastics market with a 48.1% share, supported by a rapidly growing automotive sector, strong manufacturing capabilities, and increasing demand for lightweight materials in vehicle production.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302