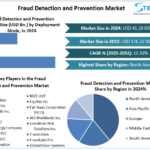

Fraud Detection and Prevention Market size was valued at USD 41.20 Bn. in 2024 and the total Fraud Detection and Prevention Market size is expected to grow at a CAGR of 19.92% from 2025 to 2032, reaching nearly USD 176.22 Bn. by 2032.

Market Estimation & Definition

Fraud Detection and Prevention refers to the deployment of advanced technological systems and strategies that identify, block, and mitigate fraudulent activities across digital, financial, and transactional environments. These systems integrate tools like behavioral analytics, AI-driven pattern recognition, multi-factor authentication, and biometric verification to enhance real-time monitoring and threat prevention.

With fraud schemes growing more complex and globalized, FDP solutions are becoming indispensable. As of 2024, the market stands at USD 41.2 billion and is forecast to reach over USD 176 billion by 2032, highlighting the urgency and necessity of robust digital fraud defenses across industries.

Download your sample copy of this report today! https://www.stellarmr.com/report/req_sample/Fraud-Detection-and-Prevention-Market/2169

Market Growth Drivers & Opportunities

Rise in Digital Fraud:

Global reliance on digital platforms—especially in banking, retail, and e-commerce—has given rise to advanced fraud tactics including phishing, synthetic identity fraud, account takeovers, and ransomware. Organizations are seeking intelligent, automated solutions to combat these evolving threats.

Advancement in AI and Machine Learning:

Modern FDP platforms leverage machine learning to analyze vast datasets and detect suspicious patterns that traditional rule-based systems might miss. These AI-driven models continuously learn from historical data, improving accuracy while reducing false positives and manual review workloads.

Regulatory Compliance Mandates:

Governments and regulatory bodies worldwide are enforcing stringent compliance requirements such as AML (Anti-Money Laundering), KYC (Know Your Customer), and GDPR. Organizations are compelled to adopt FDP systems that meet these legal standards while ensuring data protection.

Cloud-Based Deployment:

The rise of cloud computing enables real-time fraud monitoring and scalability at lower costs. Cloud-based FDP solutions offer faster deployment, seamless updates, and integration with third-party platforms, making them ideal for both large enterprises and small-to-medium-sized businesses.

Growth in Emerging Markets:

Developing economies across Asia, Latin America, and the Middle East are experiencing a fintech and digital payments boom, increasing the risk exposure to fraudulent activities. These markets present lucrative opportunities for FDP solution providers, particularly in mobile fraud detection and identity verification systems.

Industry-Specific Innovation:

Customized fraud detection solutions tailored for verticals such as healthcare, insurance, government, and telecom are gaining traction. Each industry faces unique fraud vectors—such as insurance claims fraud or telecom SIM swap scams—that require sector-specific FDP frameworks.

Segmentation Analysis

By Solution Type:

The FDP market includes solutions such as fraud analytics, authentication, and reporting. Fraud analytics is the cornerstone, using big data and algorithms to detect inconsistencies. Authentication technologies include biometrics, device fingerprinting, and two-factor mechanisms. Visualization and dashboard tools support real-time threat assessment and compliance reporting.

By Deployment Mode:

Deployment is broadly divided into cloud-based and on-premises systems. Cloud deployment leads the segment due to its agility, cost-efficiency, and adaptability to evolving threat landscapes.

By Organization Size:

Large enterprises have historically dominated the market, but small and mid-sized enterprises (SMEs) are rapidly adopting modular and subscription-based FDP platforms to safeguard against increasing cyber threats.

By End-Use Industry:

The BFSI (Banking, Financial Services, and Insurance) sector holds the largest share, owing to its direct vulnerability to fraud. E-commerce and retail are among the fastest-growing segments, followed by government, healthcare, manufacturing, and telecom, each adapting FDP systems to protect their digital ecosystems.

To find more information about this research, please visit: https://www.stellarmr.com/report/Fraud-Detection-and-Prevention-Market/2169

Country-Level Analysis: United States & Germany

United States:

As the largest contributor to the global FDP market, the U.S. benefits from early adoption of AI, cloud, and biometric technologies. Financial institutions, e-commerce platforms, and government agencies have heavily invested in layered security frameworks that integrate fraud detection with compliance and customer identity systems.

The U.S. also leads in innovations that combine fraud analytics with customer experience, ensuring that security doesn’t hinder user engagement. There is a strong push toward predictive analytics, blockchain-enhanced identity solutions, and machine learning algorithms that provide proactive risk mitigation.

Germany:

Germany anchors the European FDP landscape with its robust banking, insurance, and industrial base. The country’s emphasis on data protection and regulatory compliance (such as the General Data Protection Regulation) has driven organizations to integrate FDP into enterprise resource planning and transaction processing systems.

German enterprises focus on precision and efficiency, deploying advanced, rule-based engines alongside real-time analytics tools to meet EU standards. The automotive and manufacturing sectors are also adopting FDP measures to protect against procurement fraud and intellectual property theft.

Commutator Analysis (Regional & Sectoral Contrast)

Across the globe, adoption of FDP solutions varies based on economic maturity, regulatory framework, and industry digitization.

In the U.S., adoption is driven by innovation and threat response agility. Financial institutions are leading with AI-first fraud management platforms, while tech giants and government bodies integrate FDP with cyber threat intelligence systems. The trend is toward seamless fraud defense—integrated within payment flows, customer onboarding, and real-time approvals.

In Germany and broader Europe, adoption is compliance-led. Regulatory stringency shapes procurement and deployment decisions, with organizations emphasizing data localization, encryption, and traceability. While innovation is strong, it is often cautious and well-regulated.

In Asia-Pacific, particularly countries like India, China, and Southeast Asian economies, rapid digitalization has created fertile ground for fraud, spurring government and private sector investments in FDP infrastructure. The region is seeing explosive growth in cloud-based, mobile-friendly fraud tools aimed at fintech, retail, and telecom sectors.

Industry-wise, while BFSI remains the backbone, e-commerce is emerging as a high-growth sector due to a rise in card-not-present transactions and fake return scams. Healthcare and insurance sectors are also investing significantly, particularly in claims verification and digital identity management.

Conclusion

The Fraud Detection and Prevention market is undergoing a massive transformation, evolving from legacy rule-based systems into sophisticated AI-driven platforms that anticipate and neutralize fraud in real time. As digital adoption accelerates across all sectors, the need for agile, cloud-enabled, and compliant FDP solutions is stronger than ever.

With the global market projected to expand from USD 41.2 billion in 2024 to USD 176.2 billion by 2032, the coming years will witness intense innovation and fierce competition among solution providers. Leaders in the space will distinguish themselves not just through technology, but through their ability to integrate FDP solutions into business workflows, regulatory frameworks, and customer experience models.

Discover trending insights in Stellar Market Research’s newest publications:

Switzerland Banking Compliance Solutions Market https://www.stellarmr.com/report/Switzerland-Banking-Compliance-Solutions-Market/609

Europe Banking As A Service Baas Market https://www.stellarmr.com/report/Europe-Banking-as-a-Service-BaaS-Market/224

About Stellar Market Research:

Stellar Market Research is a global leader in market research and consulting services, specializing in a wide range of industries, including healthcare, technology, automobiles, electronics, and more. With a team of experts, Stellar Market Research provides data-driven market insights, strategic analysis, and competition evaluation to help businesses make informed decisions and achieve success in their respective industries.

For more information, please contact:

Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656