In the ever-evolving world of auto insurance, Usage-Based Insurance (UBI) is emerging as a game-changer, disrupting traditional pricing models and offering consumers more personalized, fairer premiums based on their actual driving habits. While national insurance giants like Progressive and Allstate have been vocal advocates of UBI, regional insurers have a unique opportunity to leverage this trend and create a competitive edge in an increasingly crowded market. This post delves into how regional carriers can tap into the UBI car insurance wave and thrive in a digital-first insurance world.

The Rise of UBI Car Insurance

UBI car insurance uses telematics—data collection technology—to monitor how, when, and how much a policyholder drives. It tracks key factors such as speed, braking, time of day, and mileage to determine the level of risk associated with a driver. Insurers then use this information to set premiums that are based on actual driving behavior, making the insurance process more transparent and fair.

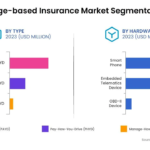

In the U.S., over 40% of auto insurance policyholders have opted for some form of UBI, with this number expected to continue rising in the coming years. As of 2023, the global UBI market is valued at $43.38 billion and is expected to reach $70.46 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.2%. Despite this growth, adoption remains uneven, and UBI car insurance is still a relatively new offering, especially among smaller, regional insurers.

The Opportunity for Regional Insurers

While national carriers have made significant strides in offering UBI, regional insurers are well-positioned to differentiate themselves and capture a share of the market. National insurers tend to offer one-size-fits-all policies, which may not account for local driving habits or risk factors. Regional insurers, on the other hand, have the advantage of deep local knowledge and can tailor UBI car insurance policies to better reflect the unique characteristics of their specific markets.

For example, local weather conditions, road types, and traffic patterns can all influence driving behavior and risk. By using localized data, regional insurers can offer more customized, relevant coverage. This level of personalization can be particularly appealing to younger, more tech-savvy drivers who are accustomed to using apps and devices that help them manage their daily lives.

The Impact of Smartphone-Based UBI: A Game-Changer for Small Insurers

One of the most significant developments in the UBI car insurance space is the rise of smartphone-based telematics, which is quickly outpacing traditional, hardware-based methods such as OBD (on-board diagnostics) dongles. As of 2024, over 75% of new passenger cars sold in the U.S. will come equipped with embedded cellular connectivity, allowing insurers to collect driving data through smartphone apps. This shift has significantly reduced the barriers to entry for regional insurers, who can now offer UBI car insurance policies without the need for expensive hardware installations.

Smartphone-based telematics not only lowers costs but also appeals to younger, digitally-native consumers who are comfortable with using their phones for a variety of services. By providing an app-based interface for tracking driving behavior, regional insurers can make the process simple, convenient, and accessible—especially for first-time car insurance buyers.

How Regional Insurers Can Leverage Local Knowledge

The real strength of regional insurers lies in their ability to understand the nuances of their local markets. Unlike national carriers, which must serve a broad audience with generic solutions, regional insurers have the flexibility to craft UBI car insurance policies that reflect the driving conditions and risk profiles of specific areas.

Take, for example, a regional insurer in the Pacific Northwest. They could use data on local weather patterns, such as rain, fog, and snow, to offer UBI policies that take these risks into account. A policyholder who drives primarily on icy roads might be offered a discount for driving habits that reduce risk in those conditions, such as slower speeds or avoiding certain high-risk areas. This level of targeted risk assessment would be challenging for larger, national insurers to replicate.

Moreover, regional carriers can use their understanding of local demographics to target underserved markets. A regional insurer in a rural area might find success by offering UBI car insurance policies to younger drivers who may be more willing to adopt new technology and are looking for ways to save on their premiums.

Regulatory Flexibility: The Key to Innovation

Another advantage regional insurers have is the flexibility provided by state-level insurance regulations. States like Arizona and Kentucky have introduced innovation sandboxes, which allow insurers to test new products—such as UBI car insurance—under relaxed regulatory conditions. These programs encourage innovation and experimentation, enabling regional carriers to pilot new offerings without the usual compliance hurdles that slow down larger, more bureaucratic insurers.

Additionally, other states such as Ohio, Texas, and Pennsylvania have begun to allow insurers to test UBI products in controlled environments, reducing the risk of regulatory backlash. These initiatives make it easier for regional insurers to introduce UBI car insurance to their customers, fine-tune their offerings, and eventually scale up.

Overcoming Challenges: Costs and Consumer Education

While the potential for regional insurers is vast, there are challenges that must be addressed. The first is consumer education. Despite growing awareness, many drivers are still unfamiliar with UBI car insurance and may be hesitant to switch from traditional policies. Regional insurers must focus on educating consumers about the benefits of usage-based pricing and how it can help them save on premiums.

Secondly, the integration of telematics systems, even those based on smartphones, still requires a level of infrastructure and investment. Regional insurers may face initial costs to develop their apps, set up data analytics platforms, and train staff to support these programs. However, these investments will likely pay off in the long run as the UBI market continues to expand.

Conclusion: Embrace the Future with UBI Car Insurance

The rise of UBI car insurance is reshaping the auto insurance industry, and regional insurers have a golden opportunity to differentiate themselves in an increasingly competitive market. By leveraging smartphone-based telematics, using their local expertise to offer customized policies, and taking advantage of regulatory sandboxes, regional carriers can tap into this growing market and build a loyal customer base. As the demand for personalized, usage-based policies continues to rise, regional insurers who act quickly and strategically will be well-positioned to lead the way in the future of car insurance.